How Can Younger Generations Buy Real Estate?

When I bought my first home in the East Bay in 1970, it cost $19,900. Five years later, my second home in Danville was $68,000. Today, that same Danville home is valued at roughly $2,000,000.

Those numbers tell a story many long-time East Bay residents understand firsthand: homeownership has become dramatically more expensive, and the path into the market has grown steeper with each decade. What concerns me most is what this means for the next generation—and whether they’ll be able to use homeownership as a foundation for wealth building the same way many of us did.

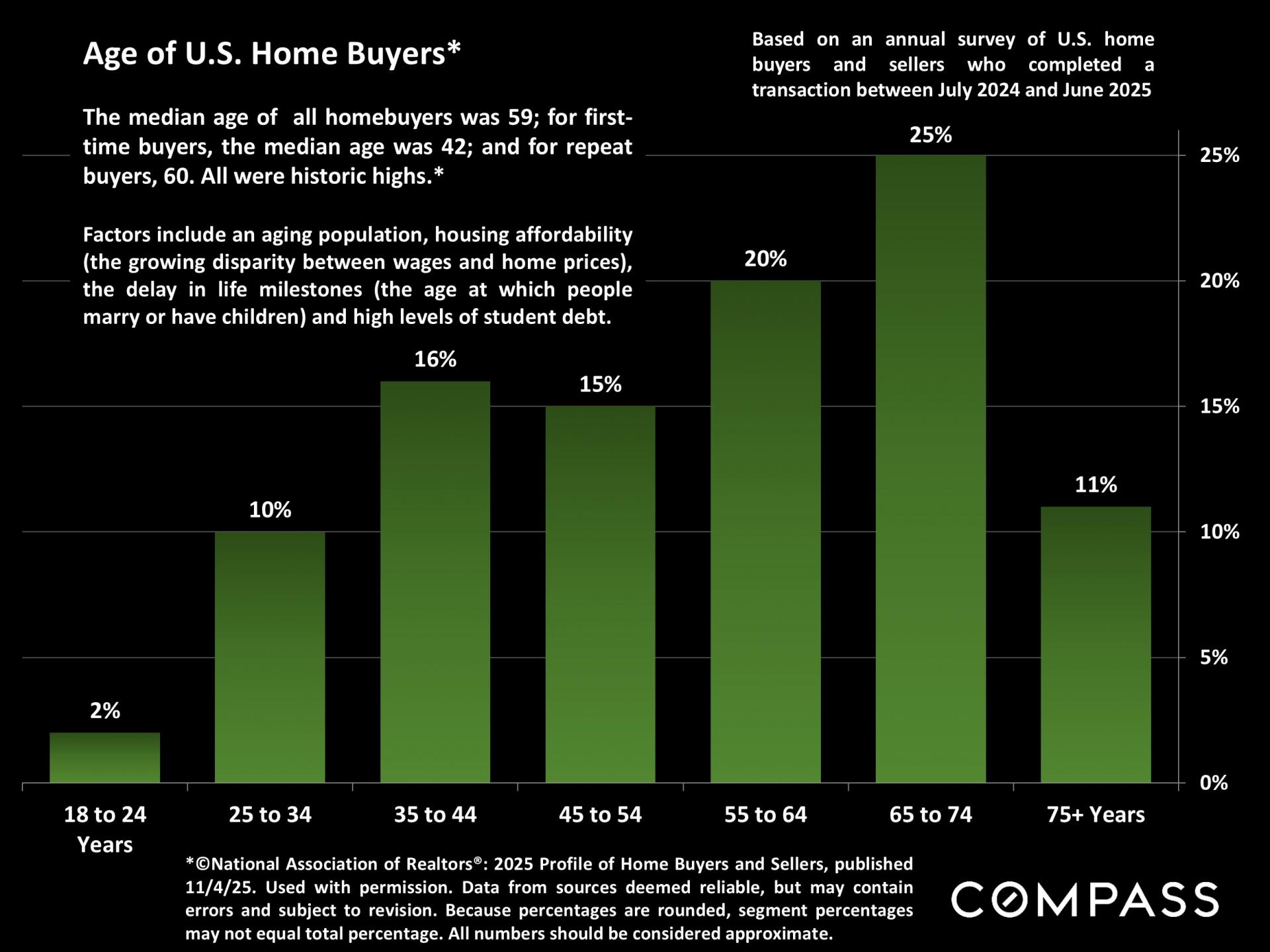

Historic Highs in the Age of Home Buyers

According to a national survey of buyers and sellers who completed a home purchase between July 2024 and June 2025, the age of U.S. home buyers has reached historic highs:

- Median age of all home buyers: 59

- Median age of first-time buyers: 42

- Median age of repeat buyers: 60

These numbers represent a major shift. For context, first-time buyers in the 1980s and 1990s often entered the market in their late 20s or early 30s. Today, they’re waiting a full decade longer, sometimes more, before buying their first home.

What’s Driving This Shift?

Several long-term trends have converged to push buyer ages upward:

1. Housing Affordability Challenges

The disparity between wages and home prices has widened for years, but in expensive coastal markets like the East Bay, the divide feels like a canyon. Even when someone earns well, the combination of limited supply and high prices makes saving for a down payment extremely difficult.

2. Mortgage Rates and Monthly Costs

With mortgage rates around 6%, the monthly cost of owning is significantly higher than renting for many East Bay households. This flips the traditional narrative...renting is often the more affordable near-term choice.

3. Delayed Life Milestones

People are getting married, having children, and settling down later in life. As a result, the typical “trigger points” for buying a home now come much later.

4. Student Debt

Younger generations face unprecedented levels of education debt, which affects both their monthly cash flow and their ability to save.

What Does This Mean for the East Bay’s Next Generation?

This is the heart of the issue. Homeownership has historically been the most reliable path to wealth accumulation in the U.S.—and especially in the Bay Area, where long-term appreciation can be extraordinary.

But if the next generation can’t get into the market until their 40s (or not at all) they miss out on decades of equity growth. The ripple effects stretch far beyond monthly payments; they influence retirement planning, financial stability, and intergenerational wealth.

So, Where Do We Go From Here?

The challenge is real, but not insurmountable. Options do exist:

- Creative financing strategies

- Buying a starter home farther from the job center

- Condo or townhouse ownership as a stepping stone

- Shared equity programs

- Purchasing with family support or co-buyers

And as major East Bay developments add new housing, including more attainable options, there’s hope for gradual improvement.

Still, it’s clear the landscape has changed. Homeownership is no longer the automatic milestone it once was; it now requires planning, strategy, and sometimes compromise. But even with these headwinds, the long-term value of owning a home—especially in a market as resilient as the East Bay—remains unmatched.

Quick Answer:

Younger generations can still buy real estate by adjusting expectations, exploring creative financing, considering condos or townhomes, buying farther from job centers, or purchasing with family or co-buyers—especially in high-cost markets like the East Bay.